What Does Wealth Management Mean?

Wiki Article

All About Wealth Management

Table of ContentsExcitement About Wealth ManagementThings about Wealth ManagementWealth Management Can Be Fun For AnyoneThe Ultimate Guide To Wealth ManagementWhat Does Wealth Management Mean?

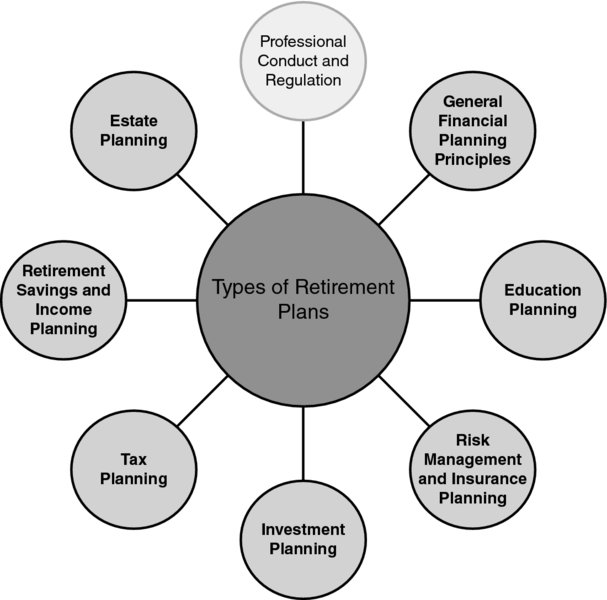

The non-financial aspects consist of way of living options such as exactly how to hang out in retired life, where to live, and when to quit working entirely, amongst other points. A holistic method to retired life preparation takes into consideration all these locations. The emphasis that one puts on retirement preparation modifications at various phases of life.

Others state most senior citizens aren't conserving anywhere near adequate to fulfill those criteria as well as should change their lifestyle to reside on what they have. While the quantity of money you'll wish to have in your savings is vital, it's also a good idea to take into consideration all of your expenditures.

What Does Wealth Management Mean?

As well as given that you'll have much more spare time on your hands, you might also wish to consider the expense of amusement and traveling. While it might be hard to come up with concrete figures, make sure to come up with a practical estimate so there are not a surprises in the future.

Regardless of where you are in life, there are numerous vital actions that put on almost everybody throughout their retired life preparation. The complying with are a few of one of the most common: Generate a plan. This consists of determining when you desire to start saving, when you want to retire, and just how much you wish to conserve for your utmost goal.

Inspect on your financial investments from time to time as well as make periodic adjustments. Retired life accounts come in many forms and also sizes.

You can and ought to contribute greater than the quantity that will certainly gain the employer match. Some experts recommend upwards of 10%. For the 2023 tax year, individuals under age 50 can add approximately $22,500 of their profits to a 401( k) or 403( b) (up from $20,500 for 2022), some of which might be furthermore matched by an employer. wealth management.

The 6-Second Trick For Wealth Management

The standard private retired life account (INDIVIDUAL RETIREMENT ACCOUNT) lets you place apart pre-tax dollars. This indicates that the cash you save is deducted from your revenue before your taxes are secured. It lowers your taxable income and, therefore, your tax liability. So if you get on the cusp of a higher tax obligation bracket, purchasing a typical IRA can knock you down to a lower one.When it comes time to take distributions from the account, you are subject to your conventional tax price at that time. Keep in mind, however, that the money grows on a tax-deferred basis.

Roth IRAs have some restrictions. The payment limitation for either IRA (Roth or conventional) is $6,500 a year, or $7,500 if you are over age 50. Still, a Roth has some revenue limits: A single filer can add the sum total just if they make $129,000 or much less every year, since the 2022 tax year, as well as $138,000 in 2023.

All About Wealth Management

It works the same way a 401( k) does, allowing employees to save money automatically with payroll reductions with the choice of a company suit. This quantity is capped at 3% of a worker's yearly income.Catch-up payments of $3,500 allow workers 50 or older to bump that restriction up to $19,000. When you set up a retired life account, the question becomes just how to direct the funds.

Below are some standards for successful retired life planning at different phases of your life. Those starting grown-up life may not have a lot of money totally free to spend, but they do have time to allow financial investments mature, which is a crucial and useful item of retirement savings. This is since of the concept of worsening.

Also if you can only deposit $50 a month, it will certainly deserve three times a lot more if you spend it at age 25 than if you wait to begin spending until age 45, thanks to the delights of compounding. You may be able to spend more money in the future, yet you'll never ever have the ability to offset any kind of lost time.

How Wealth Management can Save You Time, Stress, and Money.

It's crucial to continue saving at this phase of retirement planning. The combination of gaining more cash and read here also the moment you still need to spend and earn passion makes these years a few of the very best for hostile website here financial savings. People at this phase of retirement planning should continue to benefit from any kind of 401( k) coordinating programs that their employers provide.Report this wiki page